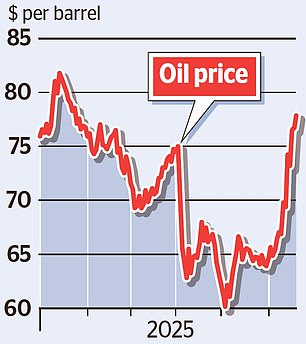

Oil soared towards $80 a barrel yesterday as industry experts warned conflict in the Middle East could send it above $100.

Brent – the global benchmark – reached a five-month high above $78 a barrel as Israel and Iran exchanged missile attacks.

And if passage through the Strait of Hormuz – a shipping route in the Persian Gulf for 20 per cent of the world’s oil – is cut off, the price could rocket higher.

The Bank of England sounded the alarm yesterday over surging oil prices, which threaten to drive inflation higher, in its interest rates decision.

Rate-setters noted that prices had risen ‘owing to an escalation of the conflict in the Middle East’.

And the Bank’s Monetary Policy Committee said it ‘would remain vigilant about these developments and their potential impact on the UK economy’.

Sea monster: BP’s Thunder Horse in the Gulf of Mexico. Brent Crude reached a five-month high above $78 a barrel as Israel and Iran exchanged missile attacks

It presents a headache for motorists as rising oil prices will feed through to the cost of fuel. A $2 increase usually adds 1p to the price of a litre, according to the AA.

But average rises are still less than a penny for petrol and diesel, the motoring association said.

‘A spike in the oil price looks daunting but it is taking its time to filter through to drivers,’ AA spokesman Luke Bosdet said.

Analysts at Goldman Sachs predict Brent could reach $90 a barrel and Barclays claimed, in the ‘worst-case scenario’ of a wider war, it could pass $100.

Shares in BP and Shell rose 1.7 per cent and 1.2 per cent respectively on hopes that higher oil prices will boost profits.

Former BP chief executive Lord Browne said the trajectory for prices ‘depends [on] what happens in the Strait of Hormuz, but if we really do shut down global supply then the price will go up a lot’.

Warning: Former BP chief exec Lord Browne (pictured) said the trajectory for prices depends on what happens in the Strait of Hormuz

‘A lot of the price is controlled by fear, fear that Iran will do something different… I think there’ll be a lot of volatility short-term,’ he told LBC.

And Shell chief executive Wael Sawan said: ‘The escalation in tensions has added to what has already been significant uncertainty in the region.

‘We’re being very careful with, for example, our shipping in the region, just to make sure that we do not take any unnecessary risks.’

At an industry conference in Tokyo, he said ‘the Strait of Hormuz is the artery through which the world’s energy flows and if that artery is blocked, for whatever reason, it’ll have a huge impact on global trade.’

Sawan said that the rise in oil and gas prices has been ‘moderate’ as investors wait to see whether physical infrastructure might be damaged.

The company is monitoring the possibility of US military action and has plans in place should things deteriorate, he said.

Uncertainty over whether Donald Trump will intervene on behalf of Israel has raged after the US President told reporters this week: ‘I may do it. I may not do it… nobody knows what I’m going to do.’

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.