‘Tax rises in November look inevitable.’ That was the warning sounded by a leading economist this morning, after government borrowing figures once again came in above target.

Official figures revealed that net borrowing came in at £18billion in August, according to the Office for National Statistics. This was £3.5billion more than in August last year and well ahead of market expectations of £12.8billion.

It is also £5.5billion higher than forecast by the Office for Budget Responsibility in March.

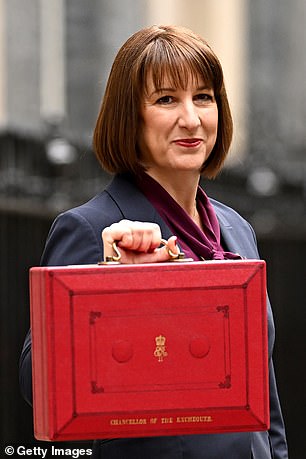

That’s bad news for Rachel Reeves and for taxpayers, who must pick up the bill for Britain’s expensive borrowing and face tax hikes to cover the cost.

The warning that tax rises must surely come in November’s Autumn Budget was sounded by Martin Beck, chief economist at WPI Strategy, who added: ‘The choice of which taxes to raise will be critical.’

In light of the almost daily stream of reports on what the Chancellor might have up her sleeve, here are the nasty tax grabs possibly coming our way – and the action we can take (if any) to mitigate them.

Our wealth risks an almighty hit as the Chancellor attempts to balance her books

How big is the problem?

Despite Rachel Reeves’s assurances in the aftermath of last year’s job-destroying effort that she would not repeat the £40billion of tax hikes she had just inflicted on the nation, every signal suggests otherwise.

According to a swathe of financial experts, our household budgets are going to take an almighty hit as the Chancellor attempts to balance her books, imbalanced by a welfare and public sector spending spree.

This time around, the tax take could be closer to £50billion, with few components of our financial armoury – pensions, savings, investments, even our homes – spared.

A frightening prospect made even more terrifying by the fact that Pensions Minister Torsten Bell has now been drafted in to plan the Chancellor’s Budget. Mr Bell, former boss of Left-leaning think-tank the Resolution Foundation, has little time for the middle classes. Help!

Mr Beck said: ‘At the current pace, borrowing in 2025-26 could overshoot the OBR’s full-year forecast by nearly £20billion, pushing the deficit close to 5 per cent of GDP

‘Informed speculation also suggests the OBR will strike a more pessimistic tine on productivity, another reason why talk of a fiscal ‘black hole’ is not misplaced.’

Pensions: What could happen and what to do

Although the Government acknowledges that collectively we are not saving enough for retirement, it doesn’t like the fact the current pensions tax system favours ‘high’ earners: those paying 40pc or 45pc tax on their income.

This is because these people receive equivalent tax relief on the contributions they make into a work or self-invested pension. In contrast, basic rate taxpayers receive a 20pc tax relief boost.

According to official figures, gross pension tax relief ‘cost’ the Government close to £80billion in the tax year to April 2024. Nearly 70pc went to higher rate taxpayers. For a socialist government, this sticks in the craw.

So we could (not will) see an announcement from the Chancellor paving the way for the introduction of a flat rate of tax relief on pension contributions.

For example, a universal 30pc rate of tax relief would give lower earners (annual earnings below £50,270) a pension boost while landing higher rate ones with tax bills. It would also raise the Government some £2.7billion a year in revenue. So a win for Labour – politically and revenue wise.

For the record, when Mr Bell was head of the Resolution Foundation, the think-tank called for a single rate of tax relief for pension savers.

If such a reshaping of the pension tax relief regime was announced in the Budget, it would unlikely be introduced until next April at the earliest. So boosting your pension now while the current regime remains in place makes great sense.

For those in work pensions, any increase in your contribution may also be matched by your employer. Even if Rachel from Accounts backs off from meddling with tax relief, any extra payments you make now will reap long-term rewards in the form of a bigger pension pot.

Boosting your pension now while the current tax relief regime remains in place makes sense

The threat to the pension tax-free lump sum

The other nasty pension change the Chancellor could announce in the Budget is a clampdown on tax-free cash that can be taken from age 55 (57 from April 2028).

Currently, most people can take 25pc of their pension pot in tax-free cash, subject to a cap of £268,275. Yet Labour, and in particular Mr Bell, are keen to curb this sum.

Mr Bell keeps telling us that pension savers should not be ‘taxed twice’ on their retirement savings.

Reassuring, but it leaves the door open for a crackdown on access to tax-free cash as he would argue that pension savers unfairly win twice over – receiving the bonus of tax relief on their pension journey, then a big chunk of tax-free cash when they retire.

At the Resolution Foundation, Mr Bell argued for tax-free cash to be capped at £40,000.

Such a move would prove controversial, but it wouldn’t deter the Chancellor who has already announced retrospective changes to the taxation of pensions with regards to inheritance tax. It would bring a smile to the face of Mr Bell, too.

It would also be a tidy tax revenue generator, with a £100,000 cap earning the Government £2billion a year.

Ahead of last year’s Budget, rumours of a cut in the tax-free pension cash that savers can take also did the rounds, only for the Chancellor to decide to back off (primarily because of the negative impact on those with public sector pensions such as doctors).

The same could happen this autumn, but with every Budget that passes and with every confirmation that the country’s finances are going to hell in a handcart, the probability of a tax-free cash curb increases.

Will she stick or twist come autumn? The smoke signals suggest a clampdown is ‘unlikely’ to be prioritised, but you can never say ‘never’ when it comes to Labour. For those who qualify – or are about to qualify – for tax-free cash, taking the money now makes sense.

Pensions minister Torsten Bell was formerly at the Resolution Foundation and advocated

Savings and investments

The lot of savers and investors will become increasingly difficult under the watch of the incumbent Chancellor.

For savers who are basic rate taxpayers, the personal savings allowance is a godsend, enabling £1,000 of annual interest from savings accounts to escape the taxman’s clutches.

For 40pc taxpayers, the allowance is worth £500.

Yet despite steady and, at times, rampant inflation, it hasn’t been increased since its introduction nine years ago and it is a racing certainty that it won’t get an uplift next April.

As with other allowances, it looks as if it isn’t going anywhere soon while Ms Reeves remains Chancellor. Indeed, with Mr Bell on board the Budget ship, the allowance could even be axed.

The freezing of the savings allowance means more than 3.35million people are in line to pay tax on savings interest this year: up from just over three million five years ago.

Although the likes of Nottingham Building Society believe the Government should do more to reward and protect savers, such calls are falling on deaf ears.

Could cash Isas still be cut?

Ms Reeves and Mr Bell are not fans of the saver and believe too many people have been encouraged by the tax system to save rather than invest for the future.

Investing, they believe, is better for the economy, even though they miss the point that without savers, banks and building societies (especially) wouldn’t be able to lend the finance necessary for people to buy the homes which Labour is keen to have built across swathes of countryside.

It’s why savers are likely to face a Budget hit with confirmation of a cut in the annual amount that can be squirrelled away inside a tax-friendly cash Isa.

Currently capped at £20,000 (the same as for investment Isas), it could be reduced to as low as £4,000 from the start of the new tax year in April.

Ms Reeves was keen to announce a cut this summer but held off as a result of fierce lobbying from the Building Societies Association and the Daily Mail and This is Money’s Save our Cash Isas campaign

Many readers, especially the risk averse and the elderly, prefer cash over investments and will never be swayed to change tack: even when interest rates are trending downwards.

So ensure you use as much of this year’s £20,000 cash Isa allowance as you possibly can – while also protecting as much of your other savings from tax by use of the personal savings allowance.

Without wishing to be patronising, don’t forget that both the cash Isa and savings allowances are per adult.

For married couples, that means £40,000 can be swept this tax year into a cash Isa while a combined £2,000 of interest from other savings can be enjoyed tax-free (assuming you are not higher rate taxpayers). Use them while you can.

Investors could face another tax raid

Although Ms Reeves may make changes to investing Isas – for example, encouraging investors to buy UK rather than overseas shares – the overall annual Isa allowance (for cash and shares combined) is likely to stick at £20,000. So use it if you want to accumulate long-term investment wealth.

This allowance may become more important if Ms Reeves listens to former deputy prime minister Angela Rayner and aligns taxes on capital gains with those applying to income.

If this were to happen, it would mean a gentle hike in capital gains tax (CGT) for basic rate taxpayers from 18pc to 20pc, although that would mean they were paying double the rate they were before her first hike last Budget.

But for higher and additional rate taxpayers, it would be much worse and result in CGT rates rising dramatically, from 24pc to 40 and 45pc, respectively.

The only bit of relief for those taking profits from the sale of shares or a second property would be the use of a £3,000 annual tax-free allowance to offset against them. Again, this has been slashed from the £12,300 it stood at as recently as two years ago, although we have former Chancellor Jeremy Hunt to thank for that.

The Chancellor signalled her intention on CGT last year when she pushed up rates from 10 and 20pc respectively for basic and higher rate taxpayers.

Given changes to CGT last year came in straightaway (and not from the start of the tax year), the same could happen second time around. As a result, a bit of shrewd investment planning ahead of the Budget could go a long way.

For example, if you have any unused Isa allowance this year, plus shares held outside of an Isa, consider transferring the latter into your tax-free account. It’s a process called ‘bed and Isa’, and it results in your shares being sold and then immediately bought back inside your Isa.

The amount that goes into the Isa counts towards your annual allowance – and crucially means all future gains (capital or dividends) are tax-free. Investing platforms provide this service although they will charge.

Stamp duty of 0.5pc is also payable on the purchase – fund repurchases are exempt. Investors should also be aware that the bedding (selling) will incur a CGT charge if the gains exceed the £3,000 nil-rate allowance.

Another tax efficient measure is to transfer investments to a spouse or civil partner if they are on a lower income tax rate. Shares disposed of by a spouse who is a higher rate taxpayer will potentially attract a bigger CGT bill than a partner who is a basic rate taxpayer.

So it makes sense for the spouse who pays the lower rate of tax to own more of the family investments. Such interspousal transfers are tax-free and apply to any financial asset – not just shares.

Shareholdings standing at a loss should be left alone until Ms Reeves jacks up CGT rates. They can then be used to offset gains made elsewhere, reducing the size of any nasty tax bill.

Will there be a fresh inheritance tax raid?

This Government despises inherited wealth. In last year’s Budget, it announced a curtailment in the inheritance tax reliefs available to those who pass on assets such as farms and private businesses.

It also confirmed the inclusion of unspent pension assets in estates from April 2027, a move which will drag tens of thousands more households into the IHT net.

Yet Labour hasn’t finished with IHT.

On the cards is a clampdown on the amount you can give away during your lifetime through the use of so called ‘potentially exempt transfers’.

Currently, such gifts become exempt from IHT provided you live for at least seven years. But Ms Reeves may tighten the IHT noose around such gifts – either by extending the waiting time for the exemption to kick in (say to ten years) or by imposing a lifetime cap (£100,000 is a figure widely bandied about).

Of course, most estates currently escape IHT, which is levied at 40pc. This is because of the existence of the ‘nil rate band’. This means a person’s estate escapes IHT if it is worth less than £325,000.

There is a further ‘residence nil rate band’ of £175,000 for those who leave their home to a child or grandchild – the full amount available for estates below £2million.

For those who are married or in a civil partnership, this potentially means a combined IHT threshold of £1million.

But financial experts say Labour’s IHT assault last year has triggered an uptick in gifting. Currently, there are numerous allowances that can be used to pass on wealth before you die. These include an annual gift allowance of £3,000 that can be made to one person or several people.

Also, if you didn’t use the allowance in the tax year ending April 5 this year, you can utilise that too. This means a couple could pass on £12,000 to friends and relatives.

Annual ‘small’ gifts of £250 can also be made to any number of other people. Such gifting is straightforward, but you must keep records of when they were made, to whom and their amount.

There are other ways to mitigate IHT – for example by using trusts or making potentially exempt transfers. But if you go down this route, it is best to seek professional advice so you do everything by the book.

One final thought on IHT. While Mr Bell was boss of the Resolution Foundation, it proposed a radical overhaul with the recipients of inheritances and gifts being taxed, not the estates. Everyone would have a ‘lifetime receipts tax allowance’. If it was exceeded, the surplus would be taxed. The foundation said it would be a big revenue generator. Don’t rule it out.

> Gifts and inheritance tax: Everything you need to know

Long-standing: Inheritance tax gift limits haven’t changed since the 1980s

The nuclear option: A tax raid on selling homes

Finally, Labour’s tax-grabbing tentacles could at some stage extend to our biggest financial asset, our cherished home.

Reports recently indicated that Ms Reeves was contemplating whether to charge capital gains tax on the profit we make when we come to sell our home.

This would result in an 18pc tax charge for basic rate taxpayers and 24pc for higher rate ones: potentially much more if Ms Reeves aligns CGT rates with income tax. Only £3,000 of the profit would be tax-free under current CGT rules.

Nothing has yet to be confirmed, or denied as is the way with this Government. And it seems that even if it went down this controversial path, it would start by imposing the tax only on high value homes (above £1.5million).

My view is that the idea will be tossed aside. Prime Minister Keir Starmer categorically ruled out such a tax charge in June last year, ahead of the General Election and he would rightly be panned if he went back on his word.

Having said that, it hasn’t deterred Sir U-turn in the past. This time, though, such a tax would also clog up the housing market with homeowners staying put rather than moving.

As Lance Corporal Jack Jones of Dad’s Army fame used to say: ‘Don’t panic.’

jeff.prestridge@dailymail.co.uk

SAVE MONEY, MAKE MONEY

Sipp cashback

Sipp cashback

£200 when you deposit or transfer £15,000

4.38% cash Isa

4.38% cash Isa

Trading 212: 0.53% fixed 12-month bonus

£20 off motoring

£20 off motoring

This is Money Motoring Club voucher

Up to £100 free share

Up to £100 free share

Get a free share worth £10 to £100

No fees on 30 funds

No fees on 30 funds

Potentially zero-fee investing in an Isa or Sipp

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. Terms and conditions apply on all offers.