House price rises are ‘losing momentum’ according to property website Zoopla, after growth fell in the year to the end of March.

It said cooling demand from buyers and a spike in homes being put on the market had combined to drag down growth and further falls are likely.

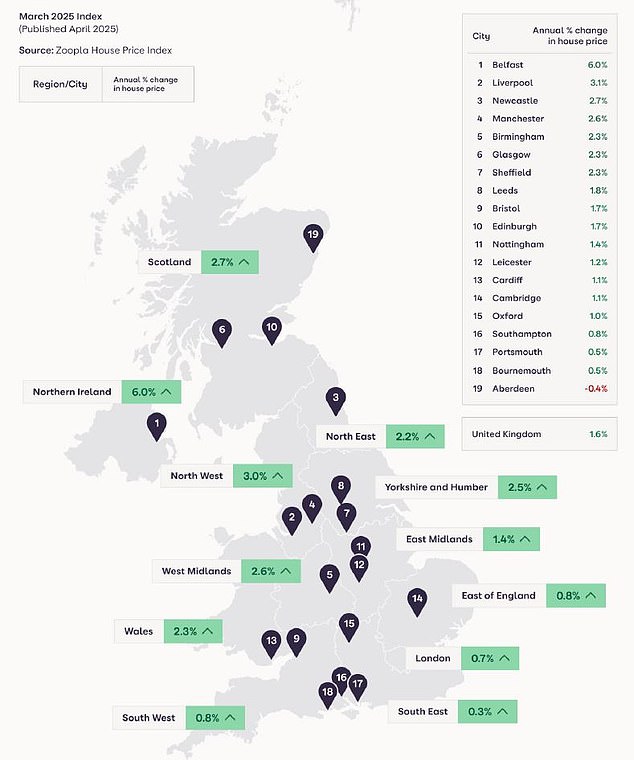

House prices went up 1.6 per cent in the year to March, compared to 1.9 per cent in the calendar year 2024, it said.

However, growth was still above the 0.2 per cent rate recorded in March 2023.

The average price of a home is £268,000, an increase of £4,270 over the past year.

Its house price index said: ‘House price inflation is losing momentum as seasonal factors and growing economic uncertainty cools buyer demand, while supply continues to expand.

‘More homes for sale are boosting choice and keeping house prices in check.’

Spoilt for choice: The number of properties up for sale spiked by 12% in the year to March

In the four weeks to 20 April there were 12 per cent more homes for sale, and 6 per cent more sales agreed, than a year previously.

Many of these sellers are also buyers, accounting for the increase in sales agreed.

The average estate agent branch had 34 homes for sale, compared to 31 at the same time last year and a low of 15 in 2022 during the pandemic boom.

But buyer demand in March was only one per cent higher than a year previously, compared to 10 per cent higher earlier in the year.

Zoopla said the increase in stamp duty on 1 April, as well as a seasonal slowdown over Easter, had also contributed to price growth falling.

US tariffs on economic growth have also increased caution amongst home buyers, it added.

Disparity: While there were more properties for sale, buyer demand increased by just 1%

Richard Donnell, executive director at Zoopla, said: ‘The housing market continues to see sellers listing their home for sale which is supporting continued growth in the number of sales.

‘This reflects a group of determined movers who remain active despite a backdrop of economic uncertainty and shifting sentiment.

‘While house price growth is expected to slow further, towards 1 to 1.5 per cent, we’re still on course for a 5 per cent uplift in sales volumes in 2025, assuming sellers remain pragmatic on pricing.

‘Regions where affordability is better aligned to local incomes, particularly across the North and Midlands, are set to lead this recovery.’

Northern Ireland bucked the trend, as house prices increased by six per cent across the year to the end of March.

The North West also saw better than average price growth at 3 per cent, while Scotland and the West Midlands saw 2.7 per cent and 2.6 per cent respectively.

Zoopla said more affordable house prices were boosting the market in these areas.

Top performers: Northern Ireland’s average property price increased by 6% in year to March

Homes in the South East of England experienced the weakest price growth, rising just 0.3 per cent over the year.

London, East England and South West England all tabled rises of less than 1 per cent.

Martin Fishwick, senior partner at North West estate agent Jordan Fishwick, said: ‘After an extraordinary March where many buyers were anxiously keen to secure their purchase prior to the stamp duty increases, the market has inevitably calmed somewhat in the North West.

‘However, there is still momentum from buyers given the significant rise in rents and the more attractive mortgage rates on offer.’

What next for house prices?

House price growth is expected to slow further over the coming months, according to the property portal.

Meanwhile it says the number of sales agreed will continue to increase due to lower interest rates.

The Bank of England is widely predicted to reduce the base rate at its next meeting on 8 May.

Home help: Mortgage lenders could be set to relax some of their borrowing rules

Though the impact of this has largely been priced in to mortgage rates already, experts predict they will stay at their current level or slightly lower.

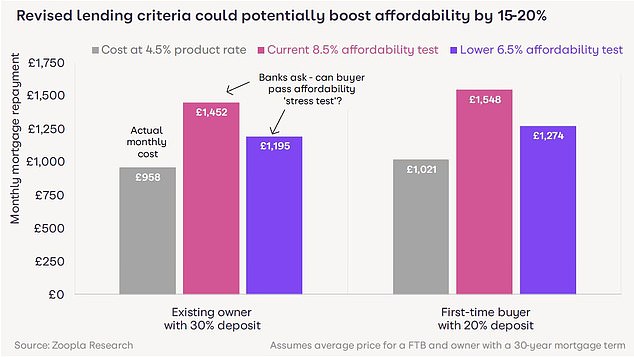

Changes in mortgage affordability tests may also drive up the number of property sales.

In recent weeks, some lenders have made adjustments which could allow borrowers to take bigger loans than they would previously have been able to.

Donnell added: ‘One of the biggest supporters of continued market activity lies with mortgage lenders.

‘Revisions to how lenders are assessing mortgage affordability will unlock additional buying power and support sales volumes to help tackle the healthy stock of homes for sale.’