Chocolate lovers could be going loco over cocoa after revelations about cutbacks to the amount of such a key ingredient in popular confectionery treats.

Club and Penguin bars are now being labelled ‘chocolate flavoured’ – a watered down description, with palm oil and shea oil increasingly filling in instead.

The moves come amid cost-cutting measures – which themselves follow failed harvests in key supplier nations such as Ghana and the Ivory Coast reducing supplies and pushing up wholesale prices.

Other mainstream snacks affected include white chocolate digestives and mini rolls.

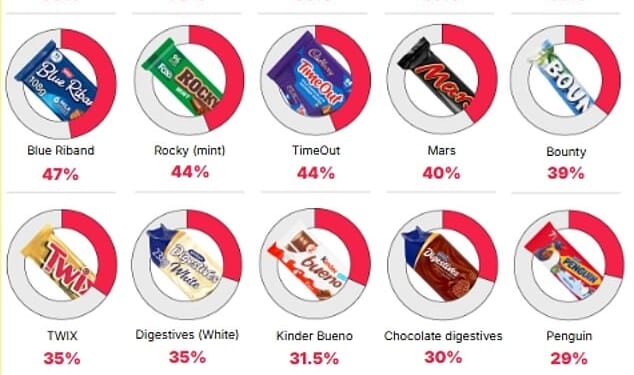

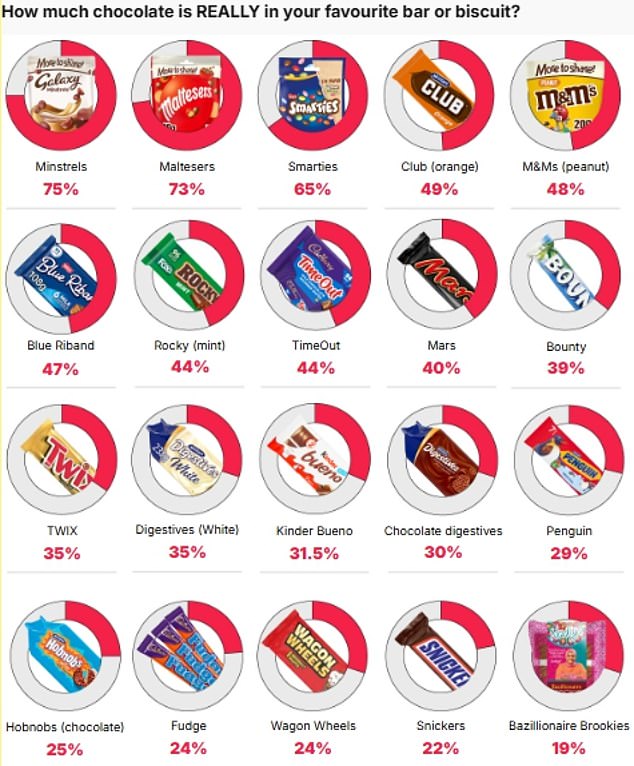

Yet there remains an array of chocolate bars and products whose makers can still boast of high percentages when it comes to cocoa content – as a new Daily Mail graphic illustrates.

Mars-owned Galaxy Minstrels top the charts with 75 per cent authentic chocolate content, according to officially listed ingredient rundowns – followed by the same firm’s Maltesers, on 73 per cent.

Nestlé’s Smarties come next on 65 per cent, a place ahead of those Club orange bars which have 49 per cent chocolate content, Tesco listings show.

Yet there are subtly nuanced descriptions involved, with the top three categorised as ‘milk chocolate’ – while Clubs are labelled as having ‘chocolate flavoured coating’.

Others shown which opt for similar tags include Penguin bars, on 29 per cent while having ‘chocolate flavoured coating’.

Others listed include McVitie’s White Digestives, 35 per cent and with ‘white chocolate flavour coating’, while Wagon Wheels (24 per cent) are believed to have been ‘chocolate flavoured coating’ for some time.

Both Club and Penguin bars are made by McVitie’s, whose parent firm Pladis confirmed they now contain more palm oil and shea oil than cocoa solids in coatings.

Other items now described by the same producer as ‘chocolate flavoured’ include Mini BN and BN Mini Rolls.

And the changing circumstances has also forced an overhaul of the long-running Club advertising slogan, formerly ‘If you like a lot of chocolate on your biscuit, join our Club’ but now ‘If you like a lot of biscuit in your break, join our Club’.

Pladis said in a statement: ‘We made some changes to McVitie’s Penguin and Club earlier this year, where we are using a chocolate flavour coating with cocoa mass, rather than a chocolate coating.

‘Sensory testing with consumers shows the new coatings deliver the same great taste as the originals.’

Pladis insisted it was committed to ‘delivering great-tasting snacks while minimising the impact of rising costs on consumers, adjusting formulations only when necessary’.

Club biscuits are now said to be ‘chocolate flavoured’ after cuts to the amount of cocoa used

White chocolate, traditionally made from cocoa butter, sugar and milk solids, must contain a minimum of 20 per cent cocoa butter to be labelled as white chocolate under UK law.

These standards demand chocolate products contain at least 20 per cent cocoa solids to be sold as milk chocolate, with Cadbury’s Dairy Milk still fitting the bill – though the European Union bar is higher at 25 per cent.

Unusual rainfall and high temperatures saw prices more than double for cocoa futures last year, hitting a record high near £8.20 per kilogram in January.

They then fell a little amid predictions of a more promising harvest and lower demand.

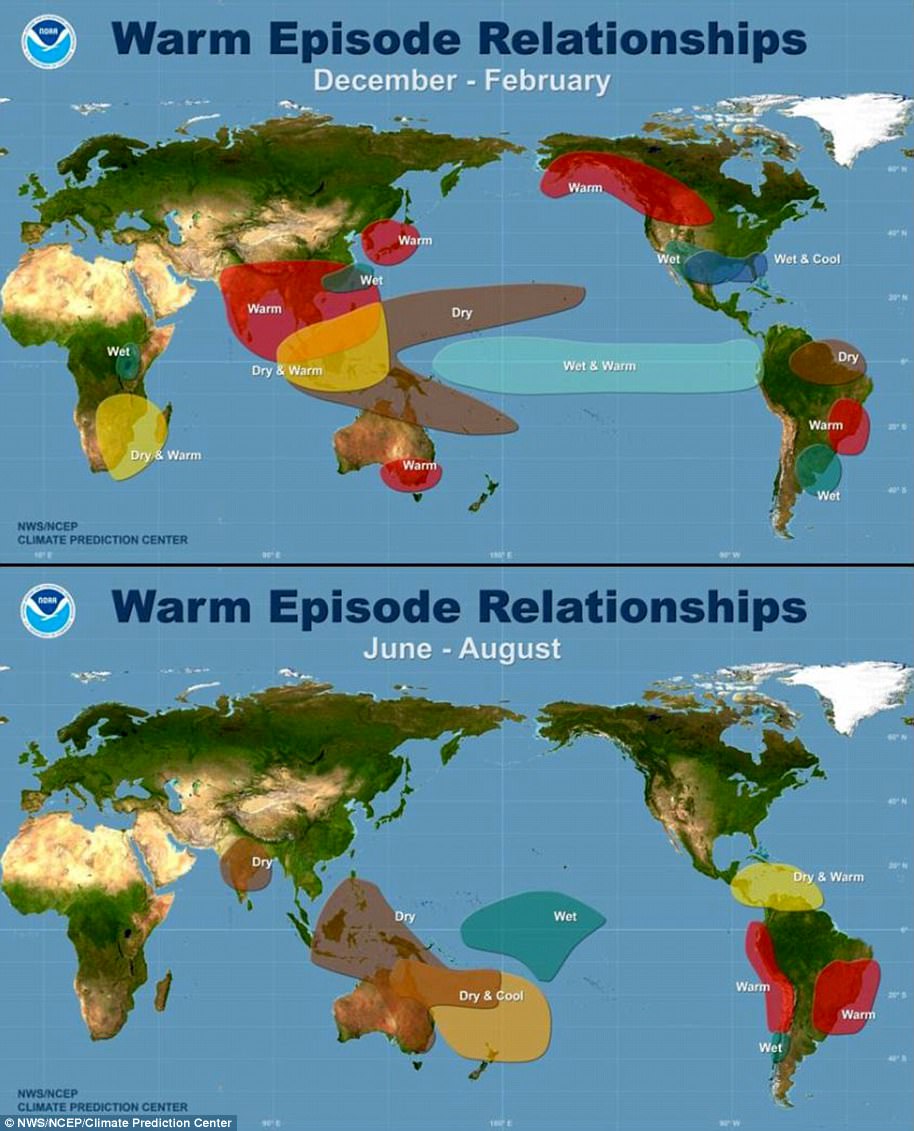

West Africa has been pummelled by climate impacts over the last three years, with extreme rainfall in 2023 which saw total precipitation more than double the 30-year average for the time of year.

This caused an outbreak of black pod disease, with cocoa plants rotting in the wet conditions – and the unpredictable weather was then followed by a drought in early 2024, typical of El Nino.

This is the warm phase of the El Niño-Southern Oscillation (ENSO) cycle, a natural climate phenomenon which sees warm sea surface temperatures in the central-east equatorial Pacific that can significantly alter weather patterns globally.

However, climate change is interacting with El Nino to drive even higher temperatures and more extreme weather.

Unusual rainfall and high temperatures saw cocoa futures prices more than double in 2024 – a farmer is pictured here arranging cocoa beans to dry in the town of Kwabeng, Ghana

As a result of the high prices, the quantity of cocoa beans the UK has imported directly from producers has decreased over the past three years.

In 2022, the UK imported 63 million kilograms worth £134 million, in 2023, the UK imported 58 million kilograms worth £127 million, and in 2024, the UK imported 57 million kilograms worth £160 million.

This means that imports of cocoa beans to the UK have fallen by 10 per cent since 2022, while the cost has risen by around 20 per cent. The average price per kilogram has also gone up by a third, meaning the UK is paying more for less cocoa.

British chocolatiers have been hit hard by the price hikes.

When the Office for National Statistics released its monthly inflation figures in March 2025, overall inflation had come down, but food price inflation had held stubbornly at 3.1 per cent.

For chocolate specifically, it had gone up from around 14 per cent the previous month to almost 17 per cent.

The changes to some treats’ cocoa make-up follows some of the UK’s most beloved Christmas chocolates reducing in size in what is known as ‘shrinkflation’.

Recent research found prices have surged by as much as 33 per cent in some instances, despite products being smaller – and again the rising cost of cocoa has been given some of the blame.

BN Mini Rolls are now described as ‘chocolate flavoured’ by biscuit maker McVitie’s

McVitie’s white digestives can no longer be marketed as ‘white chocolate’ due to similar rules

Quality Street tubs are among the sweet treats going down in size, from 600g to 550g.

While the box has decreased by 8.3 per cent, its pre-promotional price at Tesco, Sainsbury’s and Morrisons has risen by 16.7 per cent year-on-year, the Grocer revealed.

Elsewhere, the 750g tin of Cadbury Roses has reduced from 750g to 700g in Morrisons, but the price has surged from £14 to £16.50.

Terry’s Chocolate Orange has also faced similar changes, and has reduced by 7.6 per cent in size. However, in Tesco, the treat has faced a 33 per cent price hike.

In Sainsbury’s, the orange-flavoured chocolate has risen by 28.2 per cent in price, and by 25 per cent in Morrisons.

Earlier this month, Kerrygold became the latest victim of shrinkflation after its parent company Ornua slashed the size of the Irish butter blocks from 250g to 200g in the UK.

Despite the size change, retailers such as Asda and Waitrose have kept the original price, leaving customers worse off than before.

The butter, which retails at an average of £3 and is made with milk from Irish grass-fed cows, counts Kourtney Kardashian and Maura Higgins as celebrity fans.

However, since September, UK Kerrygold loyalists have had to cope with less butter per purchase after the brand introduced smaller packs.