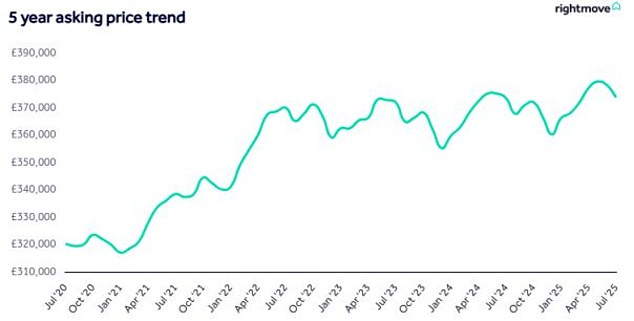

Property asking prices fell by £4,531 on average this month, according to latest figures from Rightmove.

It revealed the average price of property coming to the market for sale dropped by 1.2 per cent in July.

It means the average newly listed home is now £373,709, down from a record high of £379,517 in May.

While there’s usually a seasonal dip in prices in July, according to Rightmove, this is the largest monthly price drop at this time of year recorded for more than 20 years of data.

As a result, Britain’s biggest property portal has cut its price forecasts for the year in half, downgrading its property price predictions for 2025 from 4 per cent growth to just 2 per cent.

Dipping: Newly listed asking prices were almost £6,000 lower in July than they were in May

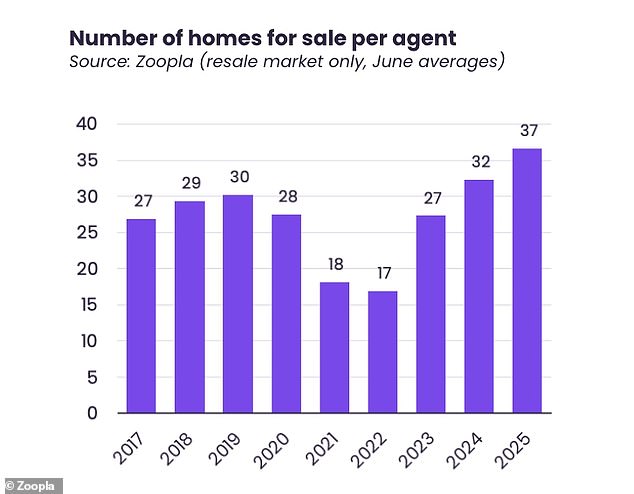

A glut of homes on the market is predominantly the cause, according to Rightmove.

It says the number of homes for sale remains at a 10 year high with an over-supply keeping a lid on prices, compounded by the start of the traditional summer holiday season.

Separate figures from Zoopla showed there were 37 homes for sale per estate agent branch in June on average across the country.

That number is up from 31 at the start of 2025 with the number of homes per estate agent rising every month so far this year.

It also is a massive increase compared to previous years. For example in June 2023 there was an average of 27 homes for sale per estate agent office while in June 2021 and 2022 there were 18 homes for sale per agent.

Rightmove says that pricing is key, and sellers who are over-optimistic on their initial asking price are increasingly at risk of getting lost among the competition.

‘What’s most important to remember in this market is that the price is key to selling,’ said Colleen Babcock, property expert at Rightmove.

‘The decade-high level of buyer choice means that discerning buyers can quickly spot when a home looks over-priced compared to the many others that may be available in their area.

‘It appears that more new sellers are conscious of this and are responding to this high-supply market with stand-out pricing to entice buyers and get their home sold.’

Glut of homes: Zoopla has reported that there were 37 homes for sale per estate agent branch in June

What are asking prices doing in different areas?

Beneath the headline national monthly price fall this July, the picture isn’t the same across the whole of Great Britain.

In the South East, average newly listed asking prices fell by 1.2 per cent this month while in the East Midlands they were flat.

London has seen the biggest regional monthly price fall, dropping 1.5 per cent, driven especially by Inner London.

Certain parts of London have seen significant falls this month. Newly listed asking prices in Camden were 2.7 per cent lower than in June, while Westminster recorded a 2.9 per cent decline.

Asking prices in Hammersmith and Fulham fell 2.5 per cent while in Southwark they dropped 2.7 per cent.

Rightmove says April’s increase in residential stamp duty in England has had a greater impact in London where property prices are higher, while last year’s increase in stamp duty for investment and second homes will also be having an effect.

A landlord or second home buyer purchasing a £1million property in the capital can now expect to pay £93,750 in stamp duty.

Additionally, changes to non-dom tax rules and uncertainty around future tax changes may be affecting investment into the central London market.

Jeremy Leaf, north London estate agent and a former RICS residential chairman, says the figures confirm what ‘he’s been seeing on the ground’ recently.

‘Asking prices are not of course values but invariably an owner’s aspirational starting point to determine if genuine buyers are attracted,’ said Leaf.

‘Sales are still being agreed but nearly always with sellers who have recognised the importance of setting a realistic initial figure to differentiate themselves from so much other, often similar, property.

‘Otherwise, buyers will take even more time waiting for the ‘right’ property and perhaps worrying about the possibility of autumn tax rises despite improving affordability – including the likelihood of imminent mortgage rate cuts.’

However, while London asking prices fell, there are regions where asking prices rose in July.

The North East, which is the least expensive region of the UK, has seen a 1.2 per cent increase in prices this month, continuing the trend of cheaper areas seeing faster price growth.

Falling: Newly listed asking prices in Westminster were 2.9 per cent lower than the previous month

Will prices go up from here?

With mortgage rates falling and two more interest rate cuts still expected in 2025, the overall outlook for the second half of the year remains positive, albeit from Rightmove’s perspective.

For some people, property may seem more affordable than it has done in recent years.

The average newly listed asking price for a UK home is now just 0.1 per cent higher than a year ago, while average earnings are up by over 5 per cent.

Meanwhile, average two-year fixed mortgage rate is now 4.53 per cent, according to Rightmove, compared with 5.34 per cent at this time last year.

For someone purchasing a home at the average asking price, this equates to a saving of nearly £150 per month on a new mortgage over 30 years and with a 20 per cent deposit.

Jeremy Leaf, a north London estate agent

Experts at the property portal are expecting the annual rate of growth to increase from its current 0.1 per cent, as they say the number of buyers out house hunting is encouraging.

‘It’s been a promising first half of the year for activity levels, particularly when you consider that some will have brought their plans forward to try to avoid added stamp duty from April,’ added Babcock.

‘Even after the stamp duty deadline, we’re seeing more sales being agreed and more new potential buyers entering the market than at the same time last year.

‘Looking ahead to the second half of 2025, there will still very likely be the usual quieter seasonal periods around the summer holidays and Christmas, but we expect market activity to continue to be resilient.

‘Crucially, buyer affordability is heading in the right direction, and another two Bank Rate cuts before 2026 would be a big boost to this.’